While buying/selling shares in the stock market, you might have noticed the term “Disclosed Quantity“.

You might be wondering what the term actually means and what is its significance in the market.

Whether you are using Upstox, Zerodha, Share Khan, or ICICI Direct, the same term Disclosed Quantity is used everywhere.

You might have also thought “What should I fill in the Disclosed Quantity?” In this blog post, I will be discussing the meaning of the Disclosed Quantity in the Stock Market and all the related queries to it.

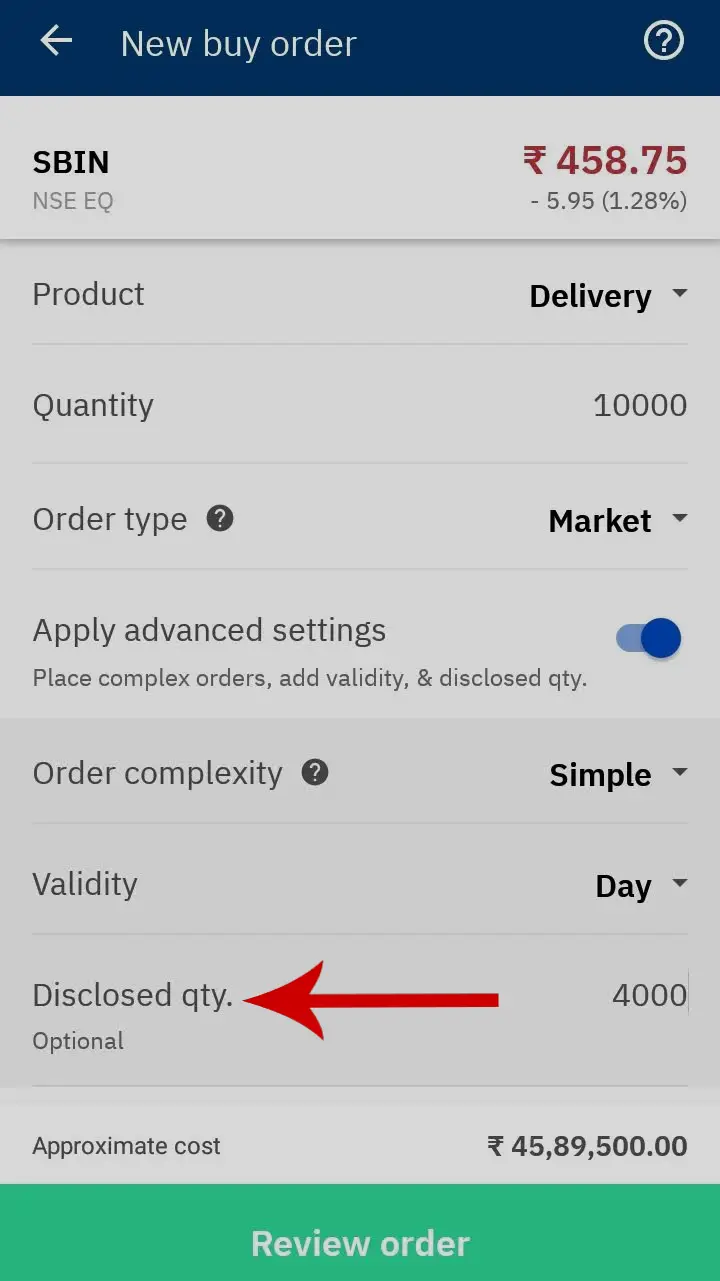

Here’s the screenshot of what it looks like in Upstox.

What is Disclosed Quantity in Share Market

Disclosed Quantity means the amount of quantity (out of the actual order quantity) that you want to disclose to the market while buying/selling shares.

Once the disclosed quantity is set, the order is sent to the Stock Exchange, and only the disclosed quantity is shown on the market screen.

Disclosed Quantity should not be greater than or equal to the actual order quantity and cannot be less than 10% of the order quantity. The minimum quantity may vary from time to time as specified by the Stock Exchange (Currently, it is 10% of the order quantity).

Example: If you buy 10,000 shares of SBIN with disclosed quantity as 2000, then only 2000 shares are displayed to the market at a time. After this is traded, another 2000 shares will be released, and so on. This will continue till the full order is executed.

Different exchanges have different disclosed quantity criteria:

- NSE/BSE (Equity) = Disclosed quantity cannot be less than 10% of your order quantity.

- NSE (CDS) = Disclosed quantity cannot be less than 10% of your order quantity.

- MCX (Commodity) = Disclosed quantity cannot be less than 25% of your order quantity.

- Disclosed quantity is not allowed in Future & Options (NSE/BSE) trading.

What is the benefit or the use of Disclosed Quantity

Disclosed Quantity helps the client to hide the actual order quantity. With disclosed quantity option, only the specified quantity is sent to the market and not the actual order quantity.

This is beneficial for someone who buys/sells shares in bulk (like hundreds or thousands). If the disclosed quantity is not specified, it may change the market sentiment by changing the stock price.

If you are trading smaller quantities, this option may not be useful. You can leave the Disclosed Quantity blank while placing an order of smaller quantities.

I hope now you have a clear idea about Disclosed Quantity. If you have any questions, please leave a comment below.

Also Read: Best Virtual Trading App